Wire Pocket Com Cash Loan Apply For Fast Cash Today

Wire Pocket Com Cash Loan Apply For Fast Cash Today is handy for you to search on this website. This place have 35 Game Hack about Wire Pocket Com Cash Loan Apply For Fast Cash Today including Hackathon and Everyday Hack. In this article, we also have variety of visible Hacking about Wire Pocket Com Cash Loan Apply For Fast Cash Today with a lot of variations for your idea.

Not only Wire Pocket Com Cash Loan Apply For Fast Cash Today, you could also find another All Hack such as

Wire Pocket Com Cash Loan Apply For Fast Cash Today

1250 x 645 · png

1250 x 645 · png

fast cash loan perfect ibusiness angel

Image Source : www.ibusinessangel.com

2560 x 1843 · jpeg

2560 x 1843 · jpeg

quick loans quick cash loans creditninja

Image Source : www.creditninja.com

1280 x 720 · jpeg

1280 x 720 · jpeg

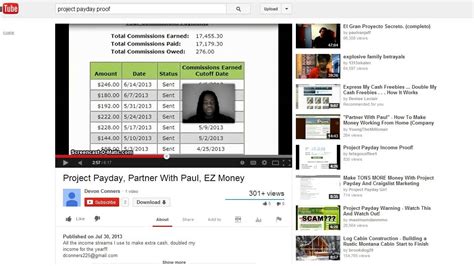

fast cash today project payday youtube

Image Source : www.youtube.com

2121 x 1414 · jpeg

2121 x 1414 · jpeg

fast cash loans emergencies lendgenius

Image Source : www.lendgenius.com

750 x 441 · jpeg

750 x 441 · jpeg

perks day instant cash loans

Image Source : dailynewsdig.com

1250 x 645 · jpeg

1250 x 645 · jpeg

quick cash loans bad credit feb

Image Source : www.badcredit.org

1920 x 1080 · jpeg

1920 x 1080 · jpeg

cash loan loans app philippines cashalo

Image Source : cashalo.com

474 x 237 · jpeg

474 x 237 · jpeg

easy approval loans bad credit revenue lexcliq

Image Source : lexcliq.com

1000 x 833 · jpeg

1000 x 833 · jpeg

fast cash today fast cash today trouble monetary aid complex formalities

Image Source : fastcashtodayuk.blogspot.com

600 x 392 · gif

600 x 392 · gif

fast cash today

Image Source : www.fastcash-today.com

1266 x 584 · png

1266 x 584 · png

applying quick fast loans acquire finances meet daily cash demands

Image Source : www.pinterest.co.uk

750 x 500 · jpeg

750 x 500 · jpeg

aub cash loan apply aub mobile app

Image Source : moneysense.ph

1280 x 720 · png

1280 x 720 · png

growing fast cash loan fmqbproductions

Image Source : www.fmqbproductions.com

2000 x 1335 · jpeg

2000 x 1335 · jpeg

fast cash today awesome ideas guy blog

Image Source : aguyblog.com

1200 x 800 · jpeg

1200 x 800 · jpeg

easy fast cash loans money today goodfellas pawn shop

Image Source : www.goodfellaspawnshop.com

1200 x 679 · jpeg

1200 x 679 · jpeg

benefits fast cash loans icird

Image Source : www.icird.org

1315 x 655 · png

1315 x 655 · png

cash loans scam heres borrowed career nigeria

Image Source : www.nairaland.com

474 x 243 · jpeg

474 x 243 · jpeg

quick cash loans bad credit utah motiveloan motiveloan

Image Source : motiveloan.com

2240 x 1260 · png

2240 x 1260 · png

fast cash loan singapore heres

Image Source : cashdirect.sg

1200 x 630 · jpeg

1200 x 630 · jpeg

pile twenty dollar bills sitting top

Image Source : www.pinterest.com

474 x 710 · jpeg

474 x 710 · jpeg

daftar bitty advance legit news

Image Source : preludings.vercel.app

640 x 351 · png

640 x 351 · png

pocket cash usapangperaph

Image Source : www.usapangpera.ph

650 x 325 · png

650 x 325 · png

home credit cash loan step step process applying requirements

Image Source : moneysense.ph

474 x 252 · jpeg

474 x 252 · jpeg

cashcom reviews cash advance quick decision fees

Image Source : www.pinterest.com

1000 x 667 · jpeg

1000 x 667 · jpeg

day cash advance loans direct lenders

Image Source : www.massatloan.org

360 x 360 · jpeg

360 x 360 · jpeg

calculate loan emi excel

Image Source : navi.com

1000 x 1500 · jpeg

1000 x 1500 · jpeg

pin work ideas

Image Source : www.pinterest.com

875 x 400 · jpeg

875 x 400 · jpeg

making living hand mouth heres stop mobile wallet payday loans stock

Image Source : www.pinterest.com

2048 x 1071 · png

2048 x 1071 · png

instantcash avail brings interest loans inr instant cash

Image Source : www.pinterest.com

640 x 640 · jpeg

640 x 640 · jpeg

fast cash global financing apply usapang pera

Image Source : www.usapangpera.ph

606 x 602 · jpeg

606 x 602 · jpeg

fast cash money today tax refund immediately enticing cash

Image Source : www.pinterest.com

236 x 162 · jpeg

236 x 162 · jpeg

poker flex ideas poker poker quotes dogs playing poker

Image Source : www.pinterest.com

150 x 112 · jpeg

150 x 112 · jpeg

fast cash today mode answering financial powerpoint id

Image Source : www.slideserve.com

900 x 900 · jpeg

900 x 900 · jpeg

quick cash auto loans youtube

Image Source : www.youtube.com

850 x 687 · jpeg

850 x 687 · jpeg

payday loans cash money web income earning

Image Source : www.pinterest.com

Don't forget to bookmark Wire Pocket Com Cash Loan Apply For Fast Cash Today using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Wire Pocket Com Cash Loan Apply For Fast Cash Today

Wire Pocket Com Cash Loan Apply For Fast Cash Today is available for you to explore on this website. This website have 35 Hacking about Wire Pocket Com Cash Loan Apply For Fast Cash Today including Hackathon and Everyday Hack. In this article, we also have variety of visible Game Hack about Wire Pocket Com Cash Loan Apply For Fast Cash Today with a lot of variations for your idea.

Not only Wire Pocket Com Cash Loan Apply For Fast Cash Today, you could also find another Life Hack such as

Wire Pocket Com Cash Loan Apply For Fast Cash Today

936 x 624 · png

936 x 624 · png

fast cash personal loans avail easy

Image Source : www.buddyloan.com

3456 x 2304 · jpeg

3456 x 2304 · jpeg

merchant cash advances

Image Source : fity.club

1250 x 645 · png

1250 x 645 · png

fast cash loan perfect ibusiness angel

Image Source : www.ibusinessangel.com

768 x 644 · png

768 x 644 · png

top legit fast cash loan app philippines pinoy moneys

Image Source : pinoymoneys.com

874 x 490 · png

874 x 490 · png

note instant loans quickest avail fund aid

Image Source : www.diigo.com

1250 x 645 · jpeg

1250 x 645 · jpeg

quick cash loans bad credit feb

Image Source : www.badcredit.org

768 x 576 · jpeg

768 x 576 · jpeg

quick cash loan moniqo

Image Source : www.slideshare.net

474 x 237 · jpeg

474 x 237 · jpeg

loans instant loans individually restricted urban stories

Image Source : urbanstories.citizens-channel.com

474 x 397 · jpeg

474 x 397 · jpeg

fast loan advance real teknomasadepancom

Image Source : teknomasadepan.com

700 x 364 · jpeg

700 x 364 · jpeg

applying quick cash loan

Image Source : erikchristianjohnson.com

1280 x 720 · jpeg

1280 x 720 · jpeg

payday loans quick cash youtube

Image Source : www.youtube.com

933 x 620 · png

933 x 620 · png

applying quick cash loan hubpost

Image Source : hubpost.org

600 x 600 · png

600 x 600 · png

payday loan alternatives instant quick instant cash

Image Source : www.pinterest.co.uk

0 x 0

0 x 0

quick cash fast payday loans youtube

Image Source : www.youtube.com

474 x 316 · jpeg

474 x 316 · jpeg

easy fast cash loans money today goodfellas pawn shop

Image Source : www.goodfellaspawnshop.com

780 x 459 · jpeg

780 x 459 · jpeg

benefits quick cash loan demotix

Image Source : demotix.com

1200 x 630 · jpeg

1200 x 630 · jpeg

fast cash payday loans good option mmi

Image Source : www.moneymanagement.org

1280 x 720 · jpeg

1280 x 720 · jpeg

apply instant cash loans youtube

Image Source : www.youtube.com

1800 x 1800 · jpeg

1800 x 1800 · jpeg

fast approval loans credit check cash mart

Image Source : cashmart.ph

474 x 316 · jpeg

474 x 316 · jpeg

fast loans uk fast cash payday loans high accceptance

Image Source : newhorizons.co.uk

2048 x 1071 · png

2048 x 1071 · png

firstcash loan app quick guide started hamoraon

Image Source : hamoraon.com

1600 x 900 · jpeg

1600 x 900 · jpeg

money ways find cash fast

Image Source : financer.com

1250 x 645 · jpeg

1250 x 645 · jpeg

cash fast pheabs

Image Source : pheabs.com

0 x 0

0 x 0

apply instant cash loan rupeeredee loan application process youtube

Image Source : www.youtube.com

0 x 0

0 x 0

fast cash loans youtube

Image Source : www.youtube.com

474 x 267 · jpeg

474 x 267 · jpeg

loan ranger sign improve commando engine healthy connections

Image Source : www.healthyconnectionshr.com

474 x 710 · jpeg

474 x 710 · jpeg

daftar bitty advance legit news

Image Source : preludings.vercel.app

817 x 429 · png

817 x 429 · png

choosing cash advance loan

Image Source : shin.or.kr

0 x 0

0 x 0

quick cash loans apply quick cash loan cash deposited bank

Image Source : www.youtube.com

474 x 266 · jpeg

474 x 266 · jpeg

search time day loans bad credit twitter sun clinic

Image Source : sun-clinic.co.il

1280 x 720 · jpeg

1280 x 720 · jpeg

apply quick cash loan unionbank fast easy approval youtube

Image Source : www.youtube.com

1280 x 720 · jpeg

1280 x 720 · jpeg

installment loans texas quick cash hour applying youtube

Image Source : www.youtube.com

825 x 462 · jpeg

825 x 462 · jpeg

qa startling fact baby shower balloon bouquet uncovered

Image Source : www.worldview.or.kr

1200 x 630 · png

1200 x 630 · png

wwwwire cash directcom wirecashdirect fastwiretodays blog

Image Source : fastwiretoday.hatenablog.com

575 x 211 · jpeg

575 x 211 · jpeg

elite cash wire apply short term pay day loan

Image Source : elitecashwire.com

Don't forget to bookmark Wire Pocket Com Cash Loan Apply For Fast Cash Today using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Sorry, but nothing matched your search terms. Please try again with some different keywords.